And it’s not just the show. Especially in Europe, we always hear about the “China speed”, quick adaptation of new (especially digital) innovation, and of course the extreme overhaul of a product or for us Westerners the seemingly unplanned introduction of a new brand. So when stepping of the plane, I was very curious to see and hear from many contacts about the status of the car and car design industry in China firsthand.

First of all, I think it is important to understand that my view is the one of a European. I had the great pleasure to have my colleague Kaiyin Su with me who is a Chinese national to explain many things to me that I would otherwise miss. Nevertheless, and as much I am walking around with open eyes and ears, I am sure seeing them as what I am: a non-resident and European walking through China.

Having said that, the Shanghai Auto Show 2025 was once again the biggest car show we can expect to see this year and has reminded me of the old days of Frankfurt. An extortionate number of Halls and stands that incredibly packed with cars, some flying objects or some robot dogs walking around. After day two I thought I had seen everything but then right before I was ready to head back into town, I found yet another concept car hidden away. That’s Shanghai for you – product overload.

And despite this overload, one thing became clear quickly. This year was not about innovation, and especially not design innovation, in any regard. Shanghai 2025 was defined by the ongoing price war in China. (Almost) Every press conference was centred around the cost of the vehicles – and prices that tried to undercut each other at almost any cost.

So, when it came to car design there were a few key observations in the relevant areas:

Exterior

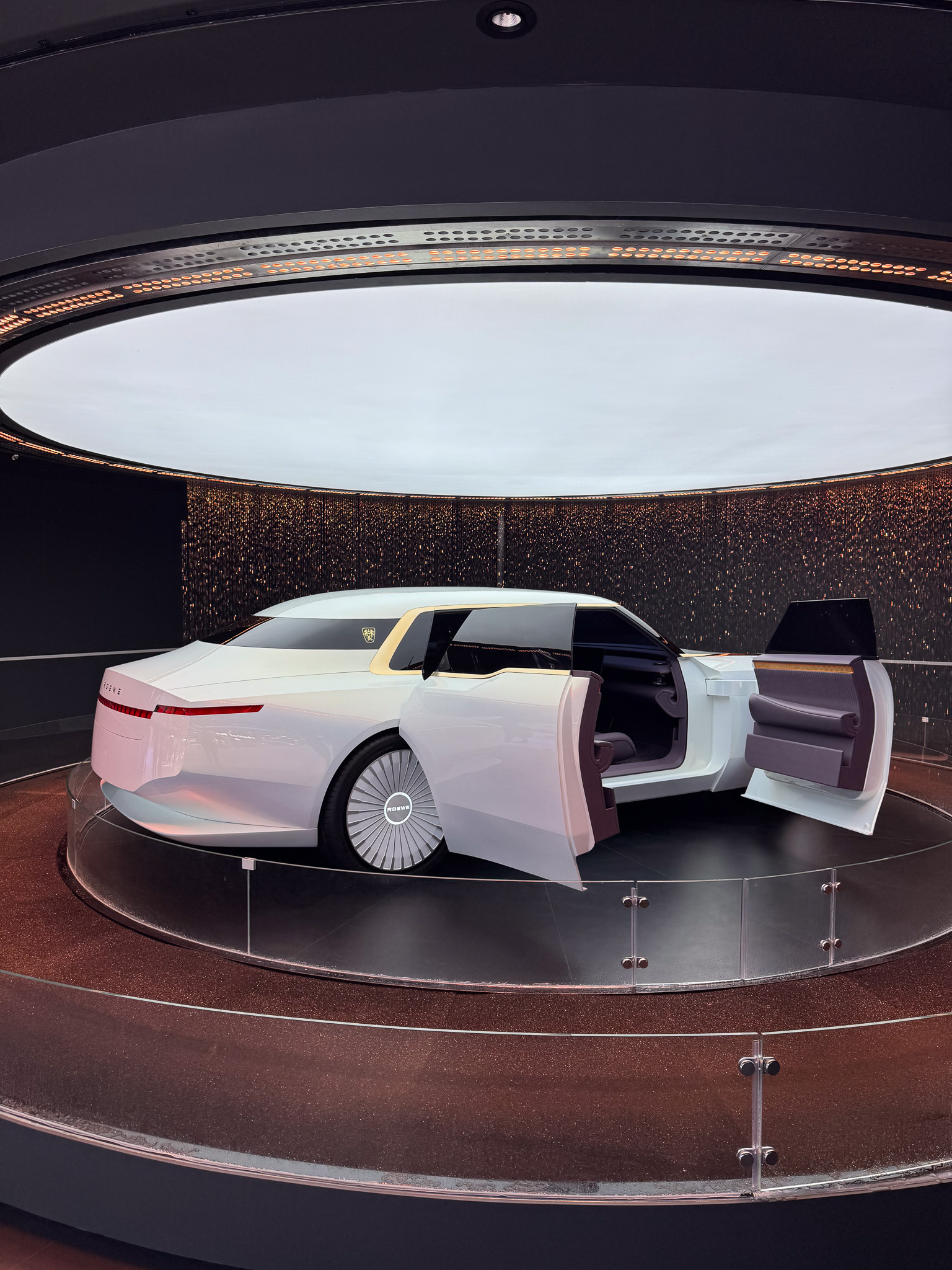

There now are 3-4 clearly defined (and heavily benchmarked) body styles that have been widely accepted by the OEMS in China. And these styles only vary in detail such as lighting signatures. The rest is almost the identical and for a foreign eye extremely difficult to distinguish. It’s not about standing out, it is much more about blending in. There was little to no experiments in the concept cars (to be fair the Chinese shows have never been the driver for concept or show cars) and what I could see was a certain ambition to let’s say be inspired by vehicles of the Rolls Royce brand. A wish not just for premium but luxury is certainly present, and yet in most cases this is going back to the early days of Chinese car design: let’s copy and iterate a bit instead of doing something on our own. The best example is that almost all rugged vehicles on the show had a clear inspiration from a G-Class, Defender, and Jeep. Some much more aggressive and militaristic than most but still not unique or outstanding. Probably the only exception here was Chery’s QQ – a positive and fun outlier. However, do not make the mistake of thinking that the exteriors in China have not been well executed. They have certainly all been professionally designed and the quality in most cases is very good. It might not be to everyone’s taste but they are mostly solid. And unlike one prominent design boss said in a public forum around the show, the Chinese design studios are certainly not their puberty phase but certainly beyond.

Interior

The price war on all levels is mostly seen on the interiors. The massive reduction of buttons and increase sizes of screens in the vehicles show the physical design of the interior is where most money is cut. This doesn’t necessarily mean that it is worse, however. While especially in the passenger seat it feels a bit “empty”, it certainly is clear and mostly quite comfortable. The wireless charger pad in the middle console is now a standard in almost all the Chinese cars and quite a few have upgradable functions integrated such as a phone holder, tables or even button bar in case you don’t like a digital only experience. While the interior gets more and more reduced, the surfaces become simpler. There are quite a few options to individualise your personal, physical experience such as fold out tablets, phone holders or even an additional cluster instrument. I did not sit in one new vehicle where the seat was uncomfortable or badly positioned. A lot of basics are done very well. Yet, with the price war the craftsmanship of interior design is simply limited and I would doubt to see any highly complex and new solutions in the next 1-2 years.

UX

I am not going to lie; this was probably my biggest disappointment of the show. Especially the UI/HMI experience in most Chinese cars has stagnated over the past 2-3. I remember when we are all blown away by the ability of the Infotainment systems a few years ago and how much especially the Europeans lacked behind. This year, it was the first time that I felt that quite a few of the Chinese manufacturers took a step back. Not necessarily in the functions (to me there are just too many and yet most people still use at least one phone on the side while driving) but in the visual quality. Xiaomi I believe is setting the standard, but many UIs are simply not well executed, and third party-app implementation mostly looks exactly like that: not adapted to the system. This probably has also to do with the price war while yet trying to offer as much “bang for the buck” as possible but of course now opens the door for the non-Chinese companies to catch up. This will be very interesting to watch and see if we hit a plateau on the digital design innovation side for the coming years, it certainly feels a bit like it. There have of course been quite a few “gimmicks” as well but nothing that I would change the way we do things…unless you like cars that start to wobble while watching a movie…

CMF

When you are walking through Shanghai the CMF picture is pretty dire. I would say 95% of all cars are either black, white and silver. And on exterior colour, the show is keeping that mostly going. There are of course quite a few tries to bring in some colour into a triste world, but the majority is black, white or silver. Something no one could really explain to me (and I expect it to be somewhere part of a current trend in China) was the amount of fur on cars. For some reason, it was cool to disguise several vehicles as animals or anime figures. If you have any insight on this, please do message me as I was simply lost. The biggest impact of CMF lies on the interior. As previously mentioned, the physical interiors have become quite simple due to the cost cuts. However, the interior materials and stitching patterns, and execution even for the cheapest cars have been very good. Stitching patterns seems to be one of the trends as many OEMs tried to find “their look” with them. Obviously, and yet again due to the price, we “feel” a lot of plastic, but the trims have been very good throughout pretty much all of the cars. It certainly felt that the CMF teams (or at least their proposals) have much more an impact in China than currently seem to have in Europe or to degree in the US. Certainly, the stand-out design division at the Shanghai show.

Brand

With the current cost and price pressure being the main theme of the Shanghai show, we yet again didn’t see any particular push about the development of brands. It is simply product first and the brand is currently non-existent or just not important. There are some positive examples, of course, NIO is still probably the leader in the field around the Chinese manufacturers. Market leaders such as BYD are certainly product first, the brand is interchangeable. The visual identities have mostly been weak for our Western standards and very inconsistent. And since the aforementioned body styles are so similar, it is become increasingly difficult to differentiate the brands if they are not visually strong. However, there has been an interesting development where the traditional and to a degree non-Chinese brands such as Volkswagen seem to have a lifeline in China. With the recent Xiaomi incident and the connected criticism around safety and testing, the chatter around the show was that many local customers have re-found an interest into brands that shown they can build reliable cars for decades. But despite this, it very much seems that brand design will only start to play a significant role once the price war and the consolidation around it is over.

Design Organisation

The Chinese OEMs are currently trending to move as much design work as possible in-house and to strengthen their capabilities. So, while the hiring is continuing strong (especially on the working level positions, management less so), the connected design supplier industry is struggling. And a bit contradictory to that, and yet explainable with the current cost focus is that we can expect a certain consolidation on the size of design teams. While they will still grow a bit (in contrary to teams in Europe or the US), we will see contracts not getting extended due to projects being cancelled and like some more “hire and hire” in the future. I would also expect that design budgets will likely not grow, but once again, more will be requested for the same money. This would then play back into the importance of a strong supplier industry to allow the OEMs to keep the fluctuation alive. Here, I only see a certain relaxation once the price war is over.

The other interesting part is that speed and especially the sketch to production time is to stay very fast (including 2-3 shifts per day on modelling for example, 10+ hour days still seem to be the norm as well), it become clear that a further push towards Design and Perceived Quality is increasingly difficult due to a lack of decades of experience and lack of highly skilled experts in the topic.

Interestingly, despite a strong push to commonality through the larger OEMs with their various brands (for example, Huawei’s Luxeed and Stelato brands seem to use the same interior architecture), it doesn’t seem that many are including that strategy into the design teams. Even if you are a studio for brand X, it doesn’t mean you might not also work for brand Y in the companies portfolio. So let’s see if we will even see brand studios in the future or if one big studio just does everything – both are currently in operation in China and there is no clear indication which direction will dominate in the future.

My last observation came a bit as a surprise: retro is coming to China without ever having been there. And it seems much more as a Chinese interpretation of what they see as retro (VW Bug and Transporter, Ford Bronco) but with a local touch. The design is almost a one-to-one copy of the “old” with new EV technology. Considering that so much of the design experience in Shanghai was somewhat conservative compared to many years before, this was a little refreshing – even if it wasn’t necessarily well executed.

It very much felt that the Chinese car design industry has plateaued. That is not too surprising. We had seen a lot of improvement and quality jumps in the past years. At some point things had to slow down a bit and even if it is led by the price war. Shanghai was impressive in its sheer size and the amount of product, but I don’t think that we will remember too much that will have a long-lasting impact on the car design industry. The current market situation simply does not allow for too much experimentation in either the design or the brand… or if something is tried it will simply be a new brand. It’s about making a profit and surviving in the market now. And company mergers like Changan and DongFeng (both state-owned) underline this even more so.

I do however think that this gives back some hope to the non-Chinese volume manufacturers. While I think that it will predominantly be a from China for China market, I think these companies do have a 1-2 window to potentially regain some market share with some new ideas. If the courage to achieve that like for example an AUDI (yes, the one with the letters and not the rings) remains to be seen.

Sign up for our newsletter and be the first

to know about our events.